Inspired by the thoughts and work of Chhatrapati Rajarshi Shahu Maharaj, Bhausaheb Shelke, who was working in a specific field like the teaching profession, changed his direction after retirement.

Read MoreFixed Deposit Account

A fixed deposit account is a type of investment account offered by banks and other financial institutions, where an investor deposits a fixed sum of money for a specified period of time (usually ranging from a few months to several years) at a fixed interest rate. The interest rate is typically higher than that offered on a regular savings account, and the rate is fixed for the entire term of the deposit.

In return for the deposit, the bank guarantees to pay the investor a fixed rate of interest on their deposit at the end of the term. The interest earned on a fixed deposit account is usually paid out at the end of the term, and the investor can choose to reinvest the principal and interest or withdraw the money.

Fixed Deposit Account Benefits

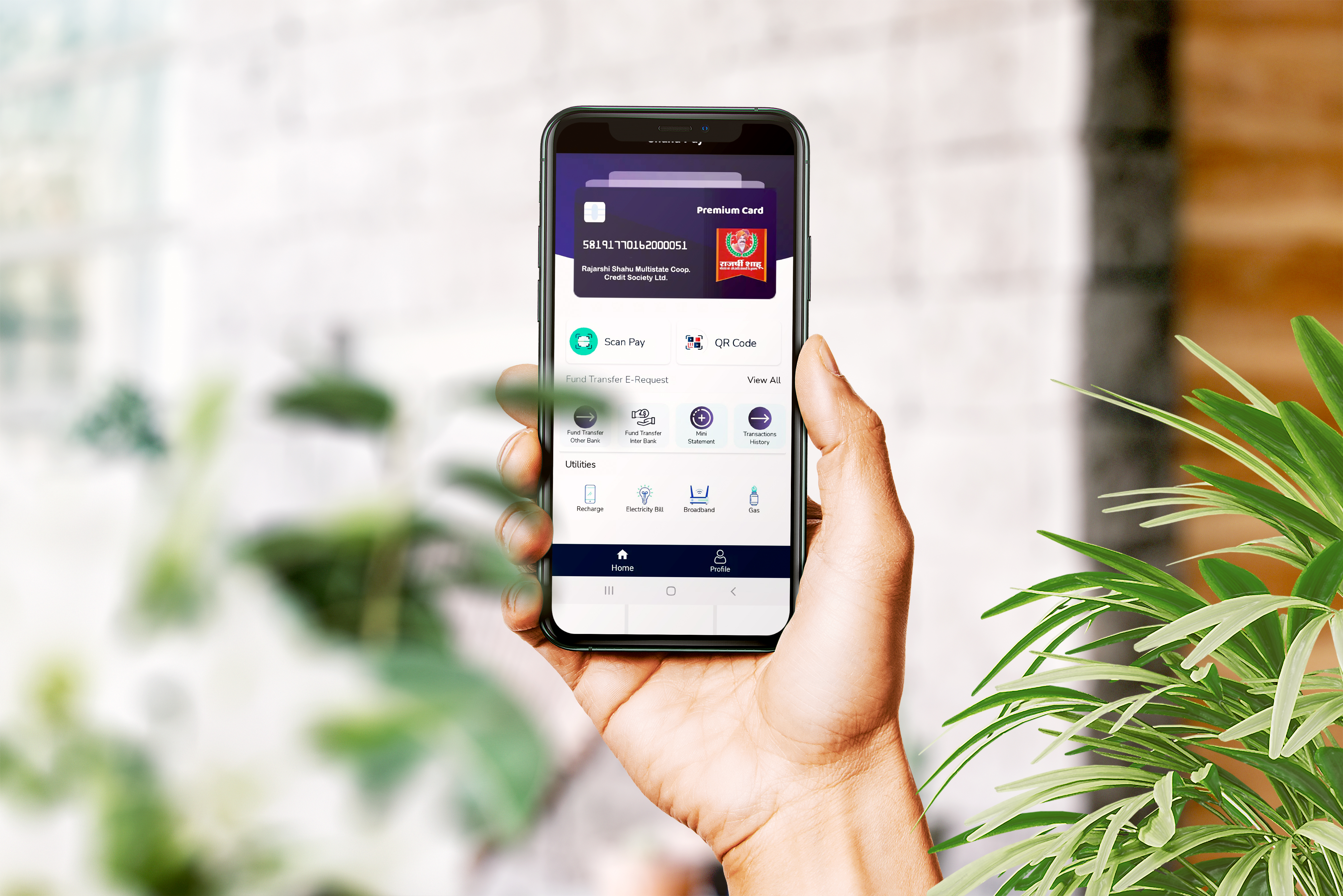

Do you want to check the account balance, the details of your recent transactions or simply transfer funds in a jiffy?

- Allows for prompt business transactions.

- No limit on withdrawals.

- No limit on deposits in the home branch.

- Provides overdraft facility

- Provides internet banking and mobile banking facilities

- Enables businessmen to make direct payments using cheques, demand drafts, or pay orders.